|

Printed in the May 31, 2019 edition on page A1 | Published on May 31, 2019 | Last Modified on May 30, 2019 at 8:43 pm

Georgetown Gazette, News

Insurance woes follow wildfires

By Dawn Hodson

It’s not news that homeowners are having trouble finding fire insurance, especially those living in the foothills, and when they do find it, it’s far more expensive than in the past.

The result of the devastating fires the state has suffered over the last few years, damage from the Camp Fire in Paradise as well as big fires elsewhere in the state have pushed claims to over $12 billion.

Paying off those claims is apparently making some insurance companies think twice about doing business in the state.

As a consequence, more homeowners are receiving notice of non-renewal, are being told to undertake extensive property improvements before their policies are renewed or are having their insurance raised substantially regardless of what they do.

Mickey Kaiserman, a board member of the El Dorado County Fire Protection District, said the issue keeps coming up at meetings because people ask them for help. “But we can’t do anything about this — it’s more of a legislative issue,” he said. “People are also concerned that lack of fire insurance will affect the value of their property.”

Tim Cordero, a division chief with the El Dorado County Fire District, echoed Kaiserman’s comments. “Some insurers are leaving the state altogether because of the risk. Homeowners are also receiving letters from their insurers in which their rates have been tripled or quadrupled or their policies have been cancelled because they are in a high fire zone,” he said. “Their only option is to go with the state FAIR Plan,” adding that even if they go with the state plan, the cost of fire insurance may go to $4,000 or $6,000 because they will need a separate policy for liability insurance.”

In some cases, insurance companies may be inventing reasons not to renew a policy. Citing one example, Cordero said the insurers cancelled a policy because they said the home was 100 feet from a fire hydrant. The fire department came out and measured it as only 60 feet and sent a letter of their findings to the insurance company but that did nothing to change the company’s mind.

Cordero said it’s also becoming difficult for people to sell their homes if the new owner can’t get fire insurance. “I believe it will take legislative relief to make it happen for people to get affordable insurance,” he said.

Leaving the marketplace

Discussing the problem from the perspective of an insurance agent is Sean Smith who is a Farmers Insurance agent as well as a broker with a business in El Dorado Hills.

“Over 40 carriers have left the market in terms of writing insurance in the foothills,” he said. “It was already limited before Paradise but the Paradise fire caused the re-insurers to start shedding policies. Liberty Mutual was a big one that sent out big, vast swaths of non-renewals. A lot of them do it by zip code or by fire score, it depends on the company.”

Smith said insurers use a company called Verisk Analytics to get a fire rating on a home. “They have a GIS (geographic information system) map of the entire U.S. They rate for slope, fuel on the property, accessibility, if there’s a fire hydrant on the property and a fire station nearby,” he said. “People can be right next to each other and yet have different policies or in some cases, the adjacent property won’t be able to find insurance.

“Big carriers like Liberty Mutual, State Farm, AAA, USAA, AllState and Nationwide have all clamped down on the markets where they will write a policy. Even Farmers has restrictions but we have partnered with the California FAIR Plan so we cover things like fire and we will write supplemental policies for liability coverage.”

However, USAA has not done badly by everyone. Available to those currently in the military, retirees, as well as family members, one Pollock Pines veteran said he saved a bundle by signing up with them after not having his policy renewed by his previous carrier.

Smith said the increase in rates is not because of the fires that have already occurred but rather to prepare for the next round of fires. “We need to be sure we have reserves to cover those types of losses,” he said. “A lot of invasive brush species are coming into these areas that have burned. These will be a fire hazard in five years.”

Last ditch insurance

Some legislative relief has been passed that offers certain protections against non-renewal of homeowners who suffer a total or partial loss due to disaster. According to the California Department of Insurance, homeowners living in a “declared wildfire disaster area of adjacent zip codes receive one year of protection from non-renewal to give them breathing room after a wildfire.”

Another law extends protection against non-renewal for those who suffer a total loss to two automatic renewals or 24 months. Both laws took effect in 2019.

For those who have not suffered a wildfire-related loss, California law provides specific rights in the events of a non-renewal. Those rights include being notified of the non-renewal at least 45 days before the policy expires; a reason or reasons for nonrenewal with the policyholder having the right to have the matter reviewed by the CDI; and the reasons for nonrenewal must involve underwriting guidelines that are objective and applied consistently.

People can use the CDI to help find insurance if their usual insurance agent or broker can’t help. A list of insurance agencies is provided on the state website at insurance.ca.gov/01-consumers/105-type/5-residential.

For those who run out of other options for finding insurance, the FAIR plan is available to homeowners as a last option for coverage. Not a state-funded plan, the FAIR Plan is a pool of all the admitted carriers in the state who pay into it based on the number of policies they have issued. The policy does not cover liability. That requires a separate policy at additional cost.

Another option is using a surplus lines broker for homeowners who cannot find coverage with an admitted insurer. That includes companies such as Lloyds of London, Lexington, Scottsdale and Hanover. They are considered nonadmitted carriers because they are not regulated by the CDI. But people should expect to pay more for coverage because of additional risk insurers assume.

Sean Smith advised people to find an admitted carrier if at all possible. That way they are assured if they have a claim, the carrier can pay it off. “People may also have to accept that the cost of insurance will be higher because it was priced too low previously. That’s why a lot of carriers have pulled out of the marketplace. It’s because they were pricing policies too low.”

Smith also advised paying attention to legislation as he said some in Sacramento are pushing to make the FAIR plan only apply to wildfire coverage.

He said new building regulations in the county require that if a person is buying a new home or adding to a new home in El Dorado County and they’re not hooked into a water system and don’t have a fire hydrant within a 1,000 feet, they will be required to have a tank full of water on the property.

Josh Hoover, an aide to Assemblyman Kevin Kiley, said while there is different legislation being proposed, none of it deals with the insurance issue. Instead it addresses topics such as creating a defensible space.

Local efforts

The rash of wildfires and difficulty in getting fire insurance has had one positive result: it’s led to more local efforts to prevent large wildfires from getting started in the first place.

In one example of that, there has been an upsurge in forming fire safe councils (FSC) with 20 of them at last count in El Dorado County.

Aggressive in going after grants to help in chipping and removing excess vegetation, millions of dollars have been brought into the county through these fire safe councils. The most recent example is a $526,000 grant from Cal Fire to help in removal of underbrush, according to Kris Payne who is a director with the Patterson Ranch FSC.

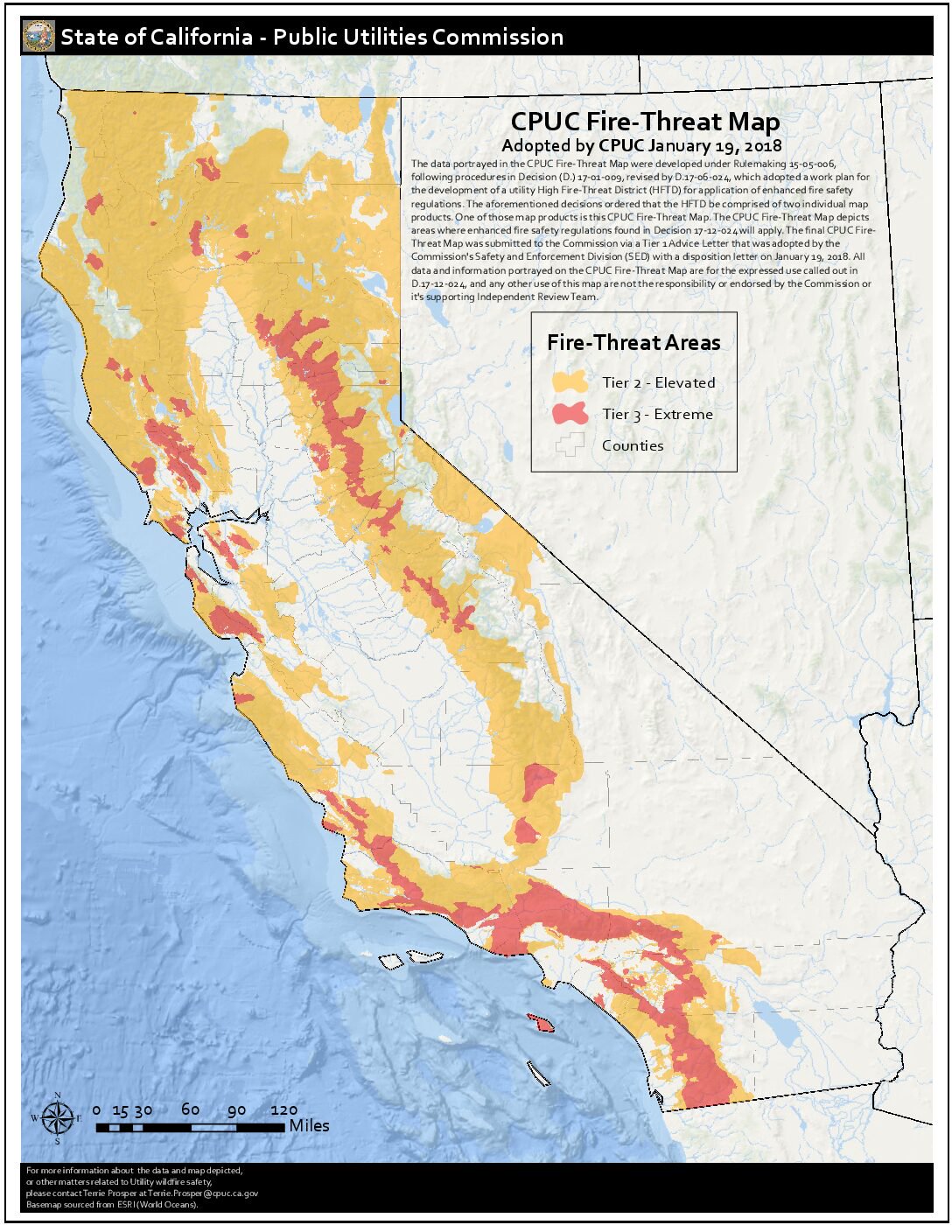

Steve Willis, the chairman of the El Dorado County Fire Safe Council, said the issue of people losing their fire insurance is, “A widespread issue that’s been going on for over a year. It started after the fire threat maps came out. The latest ones redefined the tiers of wildfire risk and now more of El Dorado County is in tier three, which is the worst.

“I’ve heard people’s fire insurance has gone up as much as six times,” he noted. “But I’ve also heard stories of people who had their insurance cancelled, the homeowner went back and created a defensible space or hardened their homes and their insurance was restored, so it’s a mixed bag but mostly on the bad side.”

On the government side, El Dorado County and the city of Placerville are in the process of finalizing a vegetation management ordinance that will require people to create defensible spaces around their homes and eliminate excess underbrush. The county recently launched a new website devoted just to vegetation management at edcgov.us/Government/CAO/VegetationManagement.

Cameron Park and El Dorado Hills already have such ordinances on the books.

The U.S. Forest Service has also undertaken an aggressive program of forest management that includes cleaning out excess timber and underbrush in the Eldorado National Forest.

Projects include the Camino-Pollock Pines fuel break, which is currently in the environmental planning stage. The fuel break will be along an 8-mile corridor north of Highway 50 extending from Slab Creek Dam near Camino to Pony Express Trail near Pollock Pines.

A work in progress is the Roadrunner Highway 50 fuel break that will be a buffer adjacent to Highway 50 from Icehouse Road to Echo Summit. Another project in the environmental planning stage is the Sly Park fuel reduction project on approximately 3,000 acres adjacent to the communities of Pollock Pines in the vicinity of Jenkinson Lake, Sly ParkRoad and Starks Grade.

Thinning and wildfire prevention projects are also planned or are currently being undertaken in the Georgetown, Volcanoville, Grizzly Flats and Omo Ranch areas.

|